STMicroelectronics Reports 2025 Second Quarter Financial Results

- Q2 net revenues $2.77 billion; gross margin 33.5%; operating loss of $133 million, including $190 million related to impairment, restructuring charges and other related phase-out costs; net loss of $97 million

- H1 net revenues $5.28 billion; gross margin 33.5%; operating loss of $130 million, including $198 million related to impairment, restructuring charges and other related phase-out costs; net loss of $41 million

- Business outlook at mid-point: Q3 net revenues of $3.17 billion and gross margin of 33.5%

Media Relations

Alexis Breton

Corporate External Communications

Tel: +33.6.59.16.79.08

alexis.breton@st.com

Investor Relations

Jérôme Ramel

EVP Corporate Development & Integrated External Communication

Tel: +41 22 929 59 20

jerome.ramel@st.com

Stay tuned

To receive frequent updates via email, subscribe to our press releases.

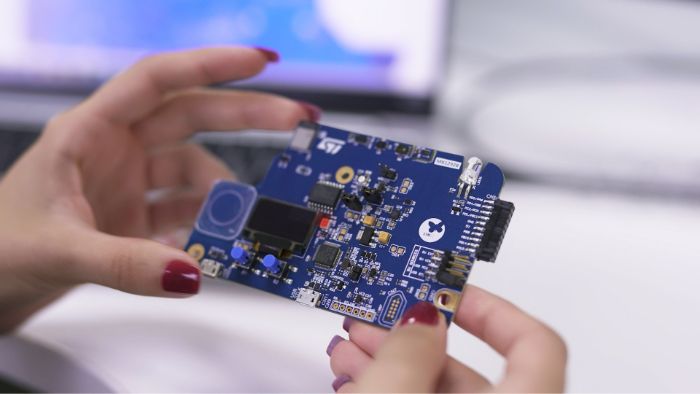

STMicroelectronics N.V. (“ST”) (NYSE: STM), a global semiconductor leader serving customers across the spectrum of electronics applications, reported U.S. GAAP financial results for the second quarter ended June 28, 2025. This press release also contains non-U.S. GAAP measures (see Appendix for additional information).

ST reported second quarter net revenues of $2.77 billion, gross margin of 33.5%, operating loss of $133 million, and net loss of $97 million or -$0.11 diluted earnings per share (non-U.S. GAAP1 operating income of $57 million, and non-U.S. GAAP1 net income of $57 million or $0.06 diluted earnings per share).

Jean-Marc Chery, ST President & CEO, commented:

- “Q2 net revenues came above the mid-point of our business outlook range, driven by higher revenues in Personal Electronics and Industrial, while Automotive was slightly below expectations. Gross margin was in line with the mid-point of our business outlook range.”

- “On a year-over-year basis, Q2 net revenues decreased 14.4%, non-U.S. GAAP operating margin decreased to 2.1% from 11.6% and non-U.S. GAAP1 net income decreased to $57 million from $353 million.”

- “First half net revenues decreased 21.1% year-over-year, with a decrease in all reportable segments. Non-U.S. GAAP1 operating margin was 1.3% and non-U.S. GAAP1 net income was $120 million.”

- “In the second quarter, our book-to-bill ratio remained above one for Industrial, while Automotive was below parity. Bookings continued to increase sequentially.”

- “Our third quarter business outlook, at the mid-point, is for net revenues of $3.17 billion, decreasing year-over-year by 2.5% and increasing sequentially by 14.6%; gross margin is expected to be about 33.5%; including about 340 basis points of unused capacity charges. On a sequential basis, our Q3 gross margin will be negatively impacted by about 140 basis points, mainly from currency effect and, to a lesser extent, the start of non-recurring cost related to our manufacturing reshaping program.”

- “While we expect Q3 revenues to show a solid sequential growth enabling a continued year-over-year improvement, we are still operating amid an uncertain macroeconomic environment. Given these external factors, our priorities remain supporting our customers, accelerating new product introductions, and executing our company-wide program to reshape our manufacturing footprint and resize our global cost base.”

1Non-U.S. GAAP. See Appendix for reconciliation to U.S. GAAP and information explaining why the Company believes these measures are important.

The press release is available as a PDF here.

related-content

Media Relations

Alexis Breton

Corporate External Communications

Tel: +33.6.59.16.79.08

alexis.breton@st.com

Investor Relations

Jérôme Ramel

EVP Corporate Development & Integrated External Communication

Tel: +41 22 929 59 20

jerome.ramel@st.com

Stay tuned

To receive frequent updates via email, subscribe to our press releases.